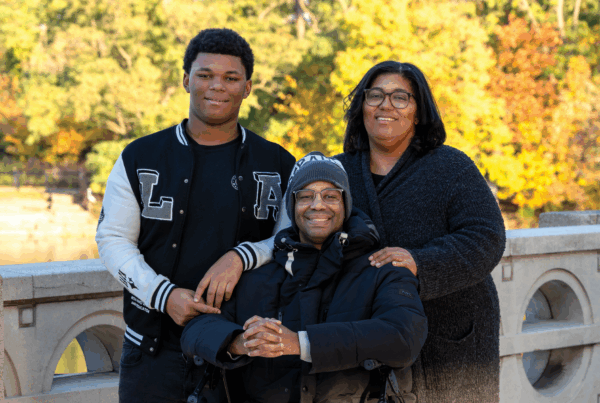

More than 150 homeless leaders from shelters and schools in Chicago and Skokie joined the Chicago Coalition for the Homeless (CCH) for a day of advocacy in Springfield on April 18.

CCH is advocating this spring legislative session on statewide measures that would impact low-income families and community college students, people in community reentry, and households facing homelessness. We brought 154 leaders to Springfield from Casa Central and La Casa Norte shelters, Earle Elementary and Schurz and Solario high schools in Chicago, and Niles West High School in Skokie.

Springfield advocacy day, April 18, 2018

CCH also works with the Responsible Budget Coalition on the Fair Tax Now campaign, advocating for a progressive income tax in Illinois.

These statewide measures are detailed below, with links to fact sheets.

Increase TANF support for needy families: The Illinois TANF program (Temporary Assistance for Needy Families) has increased monthly benefits only twice in 20 years. The current benefit level is now worth less than 25% of the federal poverty line – in Cook County, a family of three receives $432/month and a parent must participate in at least 20 hours/week of work activities. TANF grants are even lower outside the Chicago area. Illinois spends only 5% of its federal and state TANF funding on this basic assistance to families in extreme poverty. Under the Creating Opportunities for Illinoisans in Need (COIN Act), TANF grants would increase to 50% of the federal poverty line over three years (or $864/month for a family of 3), with uniform grants statewide and annual cost of living increases. CCH advocates this measure with Heartland Alliance and the Sargent Shriver National Center on Poverty Law.

(Senate Bill 3115 / House Bill 5135, lead sponsors are State Sen. Mattie Hunter and State Rep. Mary Flowers. CCH staff lead is State Legislative Director Niya Kelly).

SNAP for community college students: Gov. Rauner vetoed 2017 bipartisan legislation to make SNAP food benefits available to low-income community college students in vocational track studies. The governor noted his support except for a provision to require the Illinois Student Assistance Commission to help with implementation. But in late 2017 the Illinois Department of Human Services adopted a rule change to allow this SNAP access, now available for student applications. To ensure that this assistance remains in place, new legislation seeks to legislate SNAP access. It is estimated that SNAP would assist as many as 40,000 students studying for vocations that can lift them out of poverty. CCH continues to advocate this measure working with Heartland Alliance and the Shriver Center.

(SB351, lead sponsors are Sen. Julie Morrison and Rep. Litesa Wallace. CCH staff lead is Niya Kelly.)

Fees/fines that stall record sealing applications: The Fair Access to Employment (FATE) bill would bar judges from refusing to seal criminal records due to outstanding fines or court fees. It does not eliminate the debt but would stop counties from refusing to seal a record until all fines or fees are paid. This became an issue after people sought to seal their records, as allowed under 2017 legislation (HB2373) advocated by CCH and its partners. This is one of two bills advocated this year by the Restoring Rights and Opportunities Coalition of Illinois (RROCI), comprised of Cabrini Green Legal Aid, CCH, Community Renewal Society, and Heartland Alliance.

(HB5341, lead sponsor is Rep. Jehan Gordon-Booth. CCH staff leads are Policy Specialist Mercedes González and Senior Reentry/Latino Organizer Rachel Ramirez.)

Reentry employment discrimination: The Employee Background Fairness Act would bar employers from refusing to hire someone because of the person’s criminal history, unless s/he has a conviction related to the field of employment s/he is seeking. In the hiring process, the criminal background check is usually conducted after an offer is tentatively offered. Applicants denied because of a criminal record would have the right to an individualized review and to provide evidence of mitigating circumstances and rehabilitation. Violations can be pursued in civil court. This measure is also advocated by the RROCI coalition.

(HB5334, lead sponsor is Rep. Sonya Harper. CCH staff leads are Mercedes González and Rachel Ramirez.)

Employee Background Fairness Act fact sheet

Homeless prevention grants to at-risk households: These grants averaging $1,000 provide one-time rental and utility assistance and/or supportive services to households at risk of losing their housing. From a high of $11 million, the state currently funds prevention grants at $4.9 million. We advocate a $2 million increase. CCH first proposed this state program, which has helped more than 110,000 households since it was enacted in 2000. A Notre Dame study of the Chicago’s program found that between 2010 – 2012, those who were helped were 88% less likely to become homeless within three months and 76% less likely after six months. This assistance is cost-effective, saving the state an average $7,548 over those cost of sheltering a homeless household. CCH is advocating this with Housing Action Illinois, Alliance to End Homelessness in Suburban Cook County, and the Supportive Housing Providers Association.

In addition, CCH advocates these state funding levels:

* Homeless youth programs funded at $5.6 million, restoring $100,000 cut in FY18.

* Emergency and transitional housing (ETHS) funded at $10.4 million, a $1 million increase. In FY17, Illinois shelters served 32,793 people, almost one-third of them children under age 18.

* Supportive housing and services at $32.7 million, unchanged from FY18.

(CCH staff lead is Niya Kelly.)

Homeless prevention and ETHS budget fact sheet

Youth, homeless and housing budget fact sheet

Fair Tax campaign: The regressive and unfair tax system used in Illinois, as well as the recent two-year budget crisis, have hurt the state and harmed millions who live in poverty. Illinois needs a long-term solution. Led by the Responsible Budget Coalition, with more than 300 supporting organizations, the Fair Tax Now campaign seeks to amend the state constitution to end the flat-rate income tax, so that higher incomes pay at higher rates and middle- and low-income workers pay at lower rates. A fair tax would increase state revenues and stabilize our state’s finances.

(CCH staff leads are Niya Kelly and Senior State Network Organizer Jim Picchetti.)

– Anne Bowhay, Media